Buying a house demands a lot of thorough deliberation along with sorting out of finances and paperwork. Amidst sorting through all of these steps, a lot of home buyers fail to take cognizance of stamp duty and registration charges, which in the long run tends to derail the financial course of a home buyer.

It is important to know that getting physical possession of the property is not enough to determine ownership. It is necessary for the home buyer to pay stamp duty and carry out registration of the documents. Through this article, we will try to answer some frequently asked questions about stamp duty and registration charges.

Stamp Duty :

Stamp duty is a kind of property tax that needs to be paid when the property changes hands. The tax was levied when the Indian Stamp Act of 1899 came into place. When a person buys a property in India, he/she has to pay stamp duty based on the value and nature of the property. It is important to remember that stamp duty varies from state to state and on the kind of property i.e residential or commercial.

The tax includes transactions such as conveyance deeds, sale deed and power of attorney papers. The owner only gets complete ownership of the property after the stamp duty is paid.

How is Stamp Duty calculated?

Stamp duty is calculated based on the value of the property and its calculation changes from state to state in India. It is usually derived on the basis of the circle rate set by the state government which is subjected to revision every year.

Circle rate is the minimum price at which any real estate property has to be registered when being transferred. A circle rate is also known as the ready reckoner rate. This rate helps in gauging the property prices of a particular area.

What are the ways to pay stamp duty?

There are three ways via which one can pay stamp duty – franking, non-judicial stamp paper and e-stamping.

Franking: In this procedure, the details of the agreement are printed on a blank paper and are submitted along with the stamp duty amount to a bank that is authorized to carry out a franking transaction. Authorized banks usually charge a fee for this service.

Non-judicial stamp paper: This method requires all the details related to the agreement to be printed on the non-judicial stamp physical paper purchased from a licensed vendor. The stamp papers are then duly signed by the executants. This is the most common payment method for stamp duty.

E-stamping: As the name suggests, it is a digital payment method that makes it tamper-proof.

One needs to visit the official website of Stock Holding Corporation Limited (SCHIL) and then make the payment online. The e-stamping facility is available in only certain states, the details of which you will get from the SHCIL website.

Registration Charges:

After the stamp duty is paid, the owner has to get the registration of the property done in their name. This is a charge that the owner has to pay above the stamp duty to get the property registered in their name. The fee is usually calculated at 1% of the total cost of the property or its market value, depending on where you buy the property. In Mumbai, it is 1% of the total market value of the property or agreement value of the property or 30,000 whichever is lesser.

Documents required for Registration process

Identification documents such as Pan Card, Passport, Driving License of both the buyer and the seller

Original deed documents along with two photocopies submitted to the Sub-Registrar of Assurances

Proofof payment of stamp duty

Payment details of the transaction

Khata certificate and receipt of taxes paid

What is the process for Registration

One has to submit a sleuth of documents to commence the registration process. Once the documents are scrutinized, the owner is given a receipt and a unique serial number which denotes the completion of the registration process.

So how much does a home buyer have to pay in total?

If a male homebuyer wants to buy a residential property in Maharashtra which costs 10 lakhs then he will have to pay:

GST = Rs. 50,000

Registration Fee = Rs.50, 000

Stamp Duty = Rs. 60,000

Total amount paid to buy the property would be Rs.12, 60,000 with all the additional taxes.

Few Tips to save on stamp duty and registration charges:

We know that buying a house puts a huge dent on financials, therefore here are a few tips which will allow you save a few bucks on stamp duty and registration charges.

Some states offer rebates if the property is registered on the name of a female family member.

One can also claim the amount paid on stamp duty and registration as a deduction under section 80C of the Income Tax Act 1961. According to section 80C, the maximum deduction of stamp duty and registration charges could not exceed 1.5 lakh.

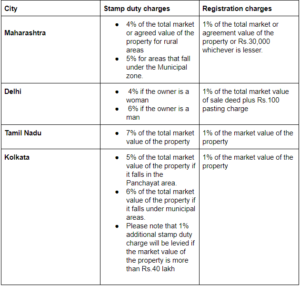

Stamp duty and registration charges of a few states: